Rising Inflation Impacts Everyday Consumers sets the stage for this enthralling narrative, highlighting how inflation is not just a macroeconomic concern but a pressing issue that grips the daily lives of individuals. As prices for essential goods soar, consumers are forced to navigate this challenging landscape, rethinking their purchasing habits and financial strategies. This discussion delves into the factors driving the current rise in inflation and its significant impact on personal finances.

From the historical trends that have shaped today’s economic environment to the psychological effects that rising prices can induce, we will explore how these changes ripple through the lives of consumers, influencing their spending, saving, and overall confidence. Understanding these dynamics is essential for adapting effectively to the shifting marketplace.

Understanding Rising Inflation

Inflation is a crucial economic concept that significantly influences the financial landscape for consumers and businesses alike. It refers to the general increase in prices of goods and services over time, eroding purchasing power. As inflation rises, each unit of currency buys fewer goods and services, which directly affects daily living expenses for consumers.Inflation is measured using various indices, with the Consumer Price Index (CPI) being one of the most common measurements.

The CPI tracks the price change of a basket of consumer goods and services, providing insight into changing cost patterns. Historical trends in inflation rates reveal significant insights into economic cycles. For instance, during the 1970s, the U.S. experienced high inflation, often referred to as “stagflation,” characterized by stagnant economic growth combined with high inflation. Such trends remind us that inflation can stem from various economic conditions, making it a critical indicator for financial planning.

Factors Contributing to Current Inflation Rise

Understanding the current rise in inflation requires examining several contributing factors. Economic theories suggest that inflation can result from demand-pull and cost-push factors. Demand-pull inflation occurs when demand for goods and services exceeds supply, leading to price increases. Conversely, cost-push inflation arises when production costs increase, resulting in higher prices for consumers.Key elements currently driving inflation include:

- Supply Chain Disruptions: The COVID-19 pandemic severely disrupted global supply chains, leading to shortages of essential goods and increased shipping costs.

- Increased Consumer Spending: As economies reopened, pent-up consumer demand surged, further straining supply chains and driving prices up.

- Rising Energy Prices: Volatile oil prices have significantly impacted transportation and production costs, contributing to overall inflation.

- Labor Shortages: Struggles to fill positions in various industries have driven wage increases, which can translate into higher prices for consumers.

Additionally, government stimulus measures, while necessary for economic recovery, have injected substantial liquidity into markets, further driving demand. These factors collectively contribute to the complexity of rising inflation, affecting everyday consumers and prompting discussions on strategic financial management.

Inflation reflects the economic pulse of a nation, affecting everything from purchasing power to interest rates.

Impacts on Everyday Consumers

Rising inflation significantly affects the daily lives of consumers, altering their purchasing power and influencing spending habits. As prices increase across various sectors, individuals and families must navigate these changes, impacting their financial decisions and overall economic well-being.One of the most direct effects of rising inflation is the erosion of purchasing power. As the cost of living rises, the same amount of money buys fewer goods and services.

This scenario forces consumers to adjust their budgets and spending behaviors. For instance, if the inflation rate is 3%, a $100 purchase today would require $103 next year for the same items. Thus, consumers may find themselves cutting back on non-essential purchases or seeking alternatives to higher-priced items.

Effects on Consumer Purchasing Power

The impact of inflation on purchasing power can be observed through several critical points. As prices increase, consumers may prioritize essential items over luxury goods, leading to changes in their consumption patterns.

- Basic necessities such as food, housing, and transportation often see the most significant price increases, forcing consumers to allocate a larger portion of their budgets to these essentials.

- Discretionary spending, including dining out and entertainment, tends to decline as households tighten their belts to afford necessary expenses.

- Brand loyalty can diminish, with consumers opting for cheaper, generic alternatives instead of preferred brands in an effort to save money.

Alterations in Consumer Spending Habits

Inflation also leads to notable shifts in consumer behavior. As prices rise, individuals adapt their spending habits in various ways to manage their budgets effectively.

- Consumers may start purchasing in bulk to take advantage of lower prices before further increases occur.

- The trend towards online shopping can intensify, as consumers seek out better deals and discounts from e-commerce platforms.

- Subscription services for essentials, like meal kits or household supplies, might become more appealing, providing perceived value and convenience amid rising prices.

Impact on Savings and Investment Choices

Inflation directly influences how consumers approach saving and investing their money. Higher inflation rates can deter individuals from saving, as the real value of their savings diminishes over time.

- Traditional savings accounts typically offer low-interest rates, which may not keep up with inflation, prompting individuals to explore alternative savings vehicles, such as high-yield savings accounts or inflation-protected securities.

- Investment strategies may shift toward assets that have historically outpaced inflation, such as stocks and real estate. Many consumers may consider diversifying their portfolios or investing in commodities like gold, which often preserve value during inflationary periods.

- Retirement planning becomes increasingly complex, with individuals needing to reassess their savings goals and investment strategies to ensure long-term financial security in the face of rising prices.

“In an inflationary environment, consumer behavior and financial strategies must adapt to maintain purchasing power and secure savings.”

Price Changes in Essential Goods

Rising inflation has notably affected the prices of essential goods, putting pressure on everyday consumers. The increase in costs for these necessities can strain household budgets and alter spending habits. Understanding how inflation impacts these essential items is crucial for anyone navigating today’s economic landscape.The following examples highlight essential items that have experienced significant price increases due to inflation. For instance, food items like bread, milk, and eggs have seen noticeable price hikes, often attributed to supply chain disruptions and increased production costs.

Similarly, energy prices, particularly fuel and electricity, have surged, impacting transportation and household utility bills. Housing costs have also escalated, driven by rising mortgage rates and rental prices.

Comparison of Price Changes Across Different Categories, Rising Inflation Impacts Everyday Consumers

To illustrate the impact of inflation on essential goods, the table below provides a comparative overview of price changes in various categories over the past year:

| Category | Essential Item | Price Change (%) |

|---|---|---|

| Food | Bread | 12% |

| Food | Milk | 10% |

| Food | Eggs | 15% |

| Fuel | Gasoline | 20% |

| Housing | Rent | 8% |

| Utilities | Electricity | 7% |

Consumers can adopt several methods to cope with the rising prices of everyday necessities. Budgeting effectively is key; tracking expenses can help identify areas where spending can be reduced. Bulk purchasing and using coupons or discount apps can also lead to savings on groceries and household items. Cooking at home rather than dining out, and prioritizing essential purchases over discretionary spending, can further mitigate the impact of inflation on household finances.

“Being proactive in managing expenses is essential during periods of rising inflation.”

Psychological Effects on Consumers

Rising inflation not only impacts the wallet but also significantly affects the emotional and mental state of consumers. As prices escalate, the uncertainty regarding the future financial landscape can lead to feelings of anxiety. Consumers often find themselves questioning their purchasing power and ability to maintain their standard of living, resulting in a heightened sense of vulnerability.The phenomenon of “inflation fatigue” emerges as consumers become desensitized to constant price increases.

This fatigue can lead to a shift in consumer behavior, where individuals begin to adjust their spending habits, often opting for cheaper alternatives or delaying purchases altogether. The cumulative effect of ongoing inflationary pressure can create a cycle of stress and cautiousness among consumers.

Impact of Inflation on Consumer Confidence

Consumer confidence is crucial for a healthy economy, as it drives spending and investment. Rising inflation tends to erode this confidence, influencing both perceptions and decision-making processes. When inflation rises, individuals may experience:

- Decreased Spending: Consumers often become more conservative with their spending as their financial security feels threatened. The fear of rising costs may lead to prioritizing essentials over discretionary spending.

- Increased Price Sensitivity: As inflation drives prices higher, consumers become more attuned to price changes, often comparing prices across various retailers to find the best deals. This shift reflects a more cautious approach to purchasing.

- Emotional Distress: The ongoing stress of inflation can lead to broader mental health issues, such as anxiety and depression. The constant worry about finances can overshadow daily life, affecting overall well-being.

- Shift in Brand Loyalty: As consumers seek to save money, they may abandon trusted brands in favor of cheaper options, impacting long-term brand loyalty and market dynamics.

The interplay between rising costs and consumer confidence can lead to overarching changes in market behavior, influencing everything from retail strategies to economic policy. Understanding these psychological effects is essential, as they play a critical role in shaping how consumers navigate a world of increasing prices and uncertainty.

Strategies for Consumers to Adapt: Rising Inflation Impacts Everyday Consumers

Rising inflation can create significant financial pressure on everyday consumers, making it essential to develop effective strategies to manage increased costs. By adopting specific budgeting techniques, exploring alternative shopping methods, and prioritizing spending, consumers can navigate these challenging economic times with greater ease and control over their finances.

Budgeting Techniques for Managing Rising Costs

Establishing a budget is crucial in times of inflation, allowing consumers to allocate their resources effectively. Here are some techniques that can help:

- Zero-Based Budgeting: This strategy involves allocating every dollar of income to specific expenses, savings, or investments, ensuring nothing is wasted.

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This method provides a balanced approach to managing expenses.

- Envelope System: Use cash envelopes for different spending categories, such as groceries or entertainment, to physically limit spending in those areas.

- Track All Expenses: Regularly monitor spending to identify areas where cuts can be made, helping to adjust the budget dynamically as needed.

Alternative Shopping Methods to Mitigate Inflation Effects

To counteract the impact of rising prices, consumers can adopt various shopping strategies. Different approaches can yield substantial savings.

- Buy in Bulk: Purchasing non-perishable items in larger quantities can lead to savings per unit, especially for staples like rice, pasta, and canned goods.

- Use Coupons and Discounts: Actively seeking coupons, cashback offers, and loyalty programs can significantly reduce overall spending on groceries and essentials.

- Shop Seasonal Produce: Buying fruits and vegetables that are in season often comes at a lower price and ensures better quality.

- Utilize Online Price Comparisons: Checking prices across various retailers online can help consumers find the best deals without having to visit multiple stores.

Prioritizing Spending in Times of Inflation

Understanding how to prioritize spending is critical when budgets are strained by inflation. A thoughtful approach can maximize value:

- Essentials First: Focus on necessities such as housing, food, healthcare, and transportation before considering discretionary spending.

- Evaluate Substitutes: Consider alternatives for expensive items, such as generic brands instead of name brands, to maintain quality while reducing costs.

- Emergency Fund Contributions: Even amid rising costs, it’s essential to continue contributing to an emergency fund to provide financial security against unexpected expenses.

- Plan for Future Expenses: Anticipate upcoming costs, like seasonal purchases or larger bills, and budget accordingly to avoid surprises.

By implementing these strategies, consumers can better adapt to rising inflation and maintain financial stability during challenging economic periods.

Government and Monetary Policy Responses

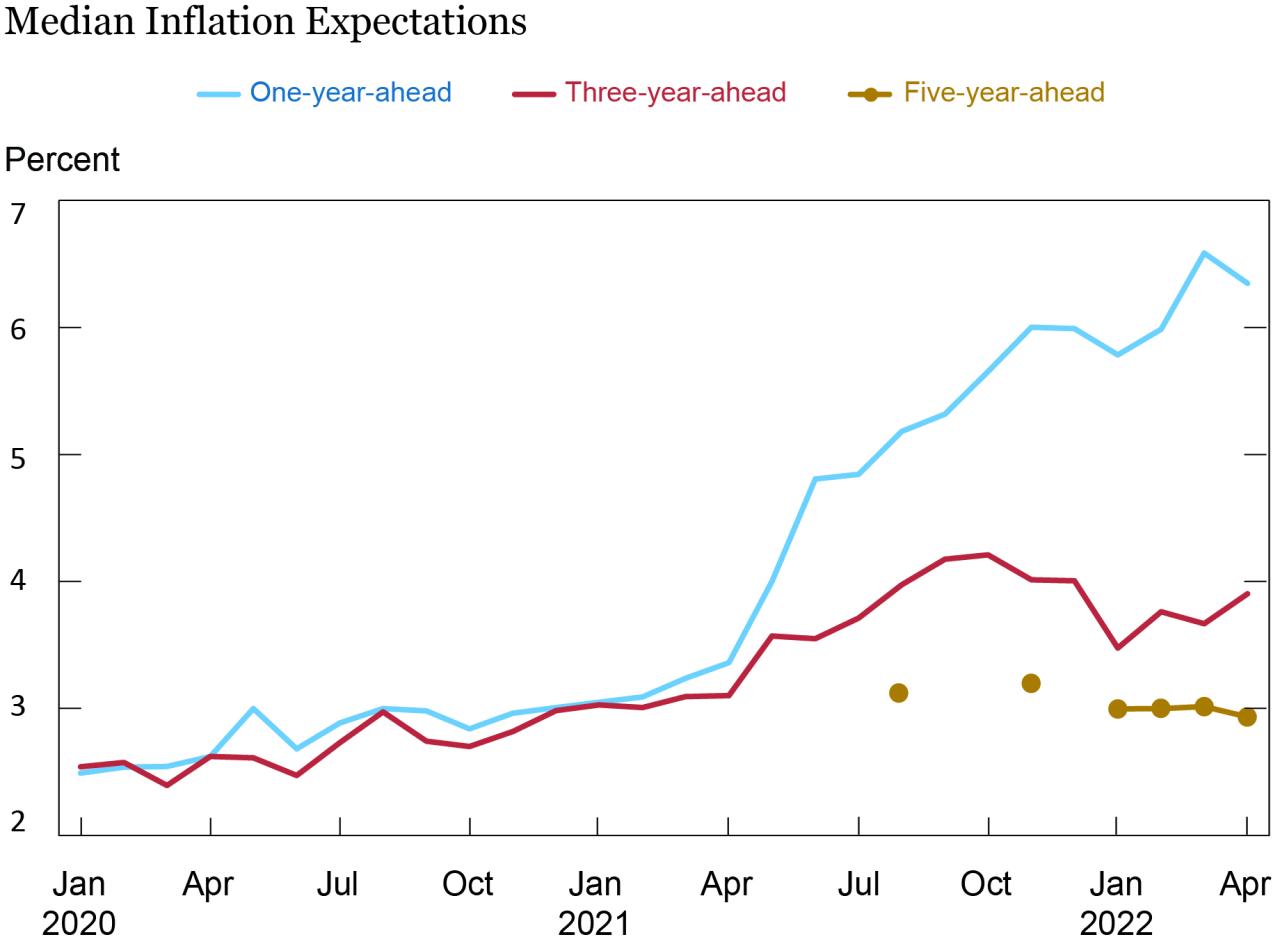

Rising inflation poses a significant challenge for consumers and the broader economy, prompting governments and central banks to take action. The role of government policy in addressing inflation is crucial; it involves a mix of fiscal measures and monetary policy adjustments aimed at stabilizing prices and maintaining economic growth. Understanding these strategies helps consumers navigate the impact of inflation on their daily lives.Central banks, such as the Federal Reserve in the United States, hold a pivotal role in controlling inflation through monetary policy.

One of the primary tools at their disposal is the adjustment of interest rates. By raising interest rates, central banks aim to cool off an overheating economy. Higher rates increase the cost of borrowing, which can lead to reduced consumer spending and investment. Conversely, lowering interest rates can stimulate spending but risks exacerbating inflation if the economy is already growing too quickly.

Interest Rates and Consumer Behavior

Interest rates significantly influence consumer behavior, especially during inflationary periods. When rates rise, consumers may alter their financial decisions, affecting everything from housing purchases to personal loans. Here are several key points illustrating this relationship:

Increased Borrowing Costs Higher interest rates translate to higher monthly payments on loans and mortgages, causing consumers to reconsider major purchases. This can lead to a slowdown in the housing market and reduced consumer confidence.

Reduced Disposable Income As consumers allocate more of their income to interest payments, they have less to spend on goods and services. This decline in disposable income can further suppress demand, potentially leading to slower economic growth.

Savings Incentives On the flip side, higher interest rates can encourage savings as consumers seek to take advantage of better returns on savings accounts and fixed deposits. Increased savings can help build financial security but may reduce immediate spending.

Consumer Sentiment Interest rates often affect consumer sentiment and perceptions of economic stability. Rising rates might evoke fears of a recession, leading to more cautious spending behavior.Central banks often implement specific measures to control inflation, which can directly impact consumers. These measures include:

Open Market Operations Central banks may sell government securities to absorb excess money from the economy, effectively tightening the money supply and helping to control inflation.

Reserve Requirements Adjusting reserve requirements for commercial banks affects how much money banks can lend. By increasing these requirements, central banks can restrict the flow of money into the economy.

Forward Guidance Central banks communicate their future policy intentions to influence market expectations. For example, if the Fed signals that it will raise interest rates, it may preemptively slow down consumer spending and borrowing.By employing these strategies, central banks and governments seek to manage inflation effectively. The impact on consumers can be profound, affecting everything from purchasing power to financial planning.

As inflation rises and falls, ongoing adjustments in government and monetary policy remain critical to maintaining economic stability and consumer confidence.